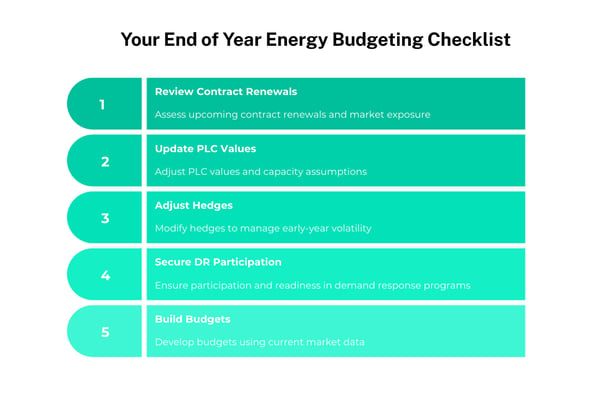

By mid-December, energy budgeting for 2026 comes down to confirming what holds up and what needs adjustment. For C&I organizations, reviewing market exposure now can help prevent avoidable surprises once the new year begins.

Below are the key areas worth assessing before January 1.

1. Reassess Contract Timing Before Market Conditions Shift

Energy budgeting often focuses on price, but timing matters just as much. As 2026 gets closer, markets are sending mixed signals, which makes it worth taking a fresh look at when energy is purchased, not only what is purchased.

According to the U.S. Energy Information Administration’s (EIA) Short-Term Energy Outlook, natural gas prices are anticipated to be higher this winter due to colder December weather and increased heating demand. Beyond the winter months, the EIA expects milder conditions and rising production to help prices ease in 2026. However, electricity demand continues to grow, especially from large users like data centers in regions such as ERCOT and PJM.

Ultimately, this means market conditions can change quickly between winter and early 2026. Reviewing contract timing now helps organizations avoid being locked into decisions made under short-term pressure.

A year-end review should include:

- Which contracts are coming up for renewal

- Any load that remains exposed heading into Q1

- How current 2026 prices compare with budget expectations

- Whether spreading purchases over time would reduce risk

2. Review PLC / Capacity Exposure to Prevent January Budget Surprises

Capacity costs continue to represent a meaningful portion of total energy spend, particularly in PJM, where capacity tags (Peak Load Contribution, or PLC) directly determine cost exposure for an entire planning year. These charges reset annually, and ignoring updated values is one of the most common reasons budgets miss the mark in Q1.

PJM’s most recent Base Residual Auction (for the 2026/2027 delivery year) cleared at $329.17/MW-day, reaching the federally approved cap across nearly the entire footprint. This represents a substantial year-over-year increase and could elevate capacity-related costs for load-serving entities and end users.

Right now, organizations should confirm:

- Updated PLC values and operational changes

that may affect them

T

he budget impact of new PJM capacity clearing prices- How capacity rates compare with assumptions used earlier in the planning cycle

While ERCOT and MISO do not structure capacity markets the same way PJM does, reviewing load obligations and peak contributions still supports more accurate early-year forecasting.

3. Strengthen Hedging Strategies for Early-2026 Volatility

Wholesale energy markets remain reactive to weather, grid constraints, and commodity fundamentals. A strong hedging strategy allows businesses to replace uncertainty with structure, creating predictable costs even when markets move quickly.

A year-end risk review should assess:

- How much of 2026 load is covered under existing hedging strategies

- Whether additional fixed-price positions would stabilize budget variance

- Whether procurement triggers need to be updated based on new price targets

- The impact of planned operational changes or expansions in 2026

Effective hedging strategies aren’t about forecasting the perfect moment to buy; they’re more like about creating a clear choice around the risks you are (and are not) willing to carry into the new year.

4. Finalize Demand Response Enrollment

Demand response (DR) programs continue to deliver reliable value for large energy users by reducing cost exposure and generating revenue during peak-demand events. Enrolling before January ensures participation for the full year.

In PJM, DR participants receive advanced notification of curtailment events, reduce their load compared to a baseline built from historical usage, and earn payments for verified reductions.

Your DR review should confirm:

- Eligibility and expected earnings

- Curtailment processes and operational readiness

- Integration with onsite generation or battery storage

Shift-planning or staffing adjustments needed to support curtailment

Building DR directly into your 2026 budget helps offset rising capacity and energy costs while strengthening overall resilience.

5. Build a Budget That Supports Flexibility

Energy budgeting effectively for the new year reflects more than projected spend. It must also create room for informed decision-making as market conditions evolve.

A strong year-end budget should include:

- Updated PLC/capacity assumptions

- Realistic forward price expectations

- Defined hedging targets and energy procurement triggers

- DR revenue projections

- Contingency planning for weather or fuel-driven volatility

Alignment with sustainability, resilience, or growth objectives

Energy budgeting built on accurate, current data provide leadership with good faith, and give energy managers the support and credibility they need to advocate for action internally.

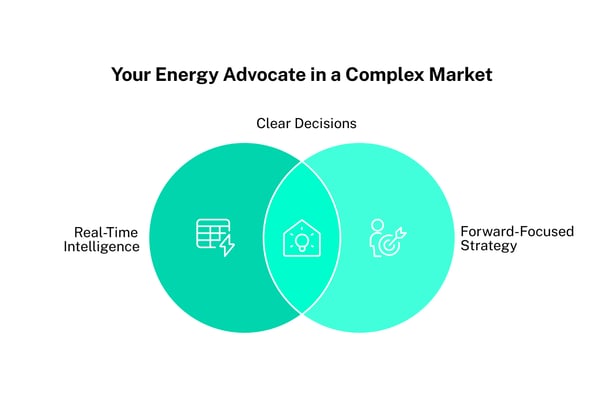

How Pilot Helps Organizations Enter 2026 Prepared

Year-end energy budgeting often exposes the same challenge. Energy managers are expected to make high-stakes decisions in a market defined by informational asymmetry. Pilot steps in to rebalance that dynamic by giving teams the clarity and support they need to make decisions with confidence.

We do that by

- Acting as Energy Advocates who help you see risk and opportunity clearly

- Providing real-time market and portfolio insight through PowerUp, our proprietary software

Helping you manage, anticipate, and save with energy procurement strategies reflects your needs, not one-size-fits-all guidance