Across the U.S., businesses are feeling the strain of rising energy demand. The rapid growth of AI and data centers is reshaping power demand and putting commercial energy buyers on the front lines of grid reliability challenges. But AI isn’t the only factor accelerating the strain. From the rise of electric vehicles (EVs) to industrial electrification and broad-based economic expansion, the next wave of grid stress is coming, and it’s arriving faster than many utility systems can adapt.

As electrification continues, grid reliability is under increasing pressure. The effects are already being felt in markets where Pilot operates every day (such as in PJM), making proactive planning essential for commercial energy buyers.

Electrification and Demand Growth Are Testing Grid Reliability.

The push to decarbonize transportation and industry is transforming how and when power is consumed. Across the U.S., utilities and regulators are seeing sharp demand increases tied to EV infrastructure, heat-pump adoption, manufacturing expansion, and fleet electrification.

- EV charging is emerging as a major new load, with large-scale charging hubs drawing energy comparable to small factories.

- Industrial electrification, including the shift away from fossil-fuel heating and process energy, is adding gigawatts of new demand in key markets.

- Regional growth in sectors like logistics, advanced manufacturing, and clean-energy production is pushing consumption even higher.

According to the U.S. Energy Information Administration (EIA), U.S. electricity consumption is projected to reach about 4,189 billion kWh in 2025 and 4,278 billion kWh in 2026, up from roughly 4,097 billion kWh in 2024, a clear signal that the era of flat demand is over.

Meanwhile, the EIA’s report on EV charging trends shows electricity use from light-duty EVs has grown nearly fivefold since 2018, reinforcing the pressure that transportation electrification is placing on regional grids.

Infrastructure Upgrades Aren’t Keeping Pace

While new generation and transmission projects are underway, many remain years from completion. In June 2025, a major heat wave across the Eastern U.S. made that reality clear.

According to the EIA’s Hourly Electric Grid Monitor, electricity demand in the PJM Interconnection, the nation’s largest wholesale electricity market, peaked at 160,560 MW on June 23, surpassing PJM’s own seasonal forecast of 154,000 MW. Real-time wholesale electricity prices skyrocketed to $1,334 per MWh at 7 p.m., compared with $52/MWh just a week earlier. At peak load, 44% of PJM’s generation came from natural gas, nuclear (20%), coal (19%), and solar (6%), with petroleum-fired generation tripling from the prior day to meet demand.

Even though PJM entered summer with roughly 179,000 MW of generation capacity and nearly 8,000 MW of contracted demand-response resources, the event underscored how quickly conditions can tighten. Earlier forecasts in PJM’s May 2025 Summer Outlook had anticipated these challenges, but the June heat wave confirmed them in real time.

The takeaway? Infrastructure alone won’t solve these challenges, but strategic planning will.

What Grid Reliability Challenges Mean for Commercial Energy Buyers

For commercial energy buyers, a tighter, more volatile grid means greater exposure to operational and financial risks:

- Price volatility: Supply-demand mismatches can trigger extreme price spikes like those seen during the summer of 2025.

- Capacity cost increases: Peak Load Contribution (PLC) events and PJM capacity planning shortfalls can lock in higher capacity charges for the following year.

- Curtailment and reliability risk: During emergencies, large commercial loads are often first to be asked (or required) to reduce consumption.

Infrastructure bottlenecks: New facilities may face connection delays or limited capacity in congested areas.

These risks have a real impact on energy costs, especially for businesses whose rates change with the market.

Demand Response and Other Strategies for Grid Reliability Resilience

While no one can control the grid, smart planning makes a big difference. The more flexible and informed your energy strategy is, the better you can handle whatever the market throws your way.

- Demand Response Programs: Participating in regional demand response initiatives allows businesses to earn revenue while supporting grid reliability. With preparation, curtailment becomes a controlled, profitable strategy rather than an unplanned disruption.

- Flexible Energy Sourcing: A diversified energy procurement strategy (combining fixed, indexed, and renewable supply) helps manage exposure to price swings and PJM capacity planning charges, especially across multi-site portfolios.

- Proactive Load Management: Monitoring and forecasting energy use enables better alignment with market signals. Identifying peaks, shifting loads, or automating equipment response can materially reduce costs and enhance reliability.

.png?width=672&height=430&name=26%20(2).png)

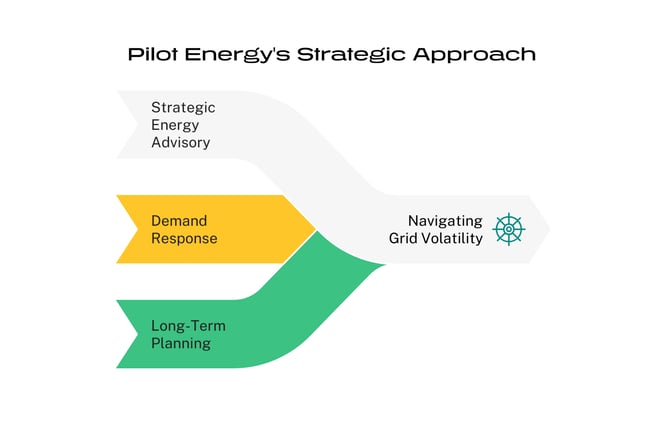

How Pilot Energy Supports Commercial Energy Buyers with Grid Reliability Planning

At Pilot Energy, we help clients anticipate and respond to evolving grid challenges through data-driven insight and hands-on energy advisory. Our experts track market conditions in real time and design energy strategies that balance cost, reliability, and sustainability, so you’re prepared, not reactive.

Here’s how we support commercial energy buyers facing today’s grid reliability pressures:

- Strategic Sourcing & Risk Management: Customized energy procurement strategies aligned to market conditions and regional grid dynamics.

- Demand Response Participation: Guidance to identify, enroll, and optimize participation in demand response programs.

- Long-Term Planning & Forecasting: Anticipate PJM capacity planning impacts and similar challenges across other major markets like ERCOT and ISO-NE, managing peak load exposure and integrating renewable solutions effectively.

About Pilot Energy

Pilot Energy is a boutique energy advisory and procurement partner helping businesses manage rising energy costs with confidence and clarity. Founded in 2001, we provide independent, data-driven strategies for energy procurement, energy risk management, utility cost reduction, and long-term commercial energy savings.

We work closely with finance, operations, and sustainability teams to create custom energy roadmaps, aligning energy procurement, forecasting, and carbon reduction goals. With a blend of market expertise and digital platforms, we help you reduce volatility, improve budget predictability, and plan smarter in any market.

Schedule a consultation with Pilot Energy today and start building a smarter energy strategy.

%20(3).png)